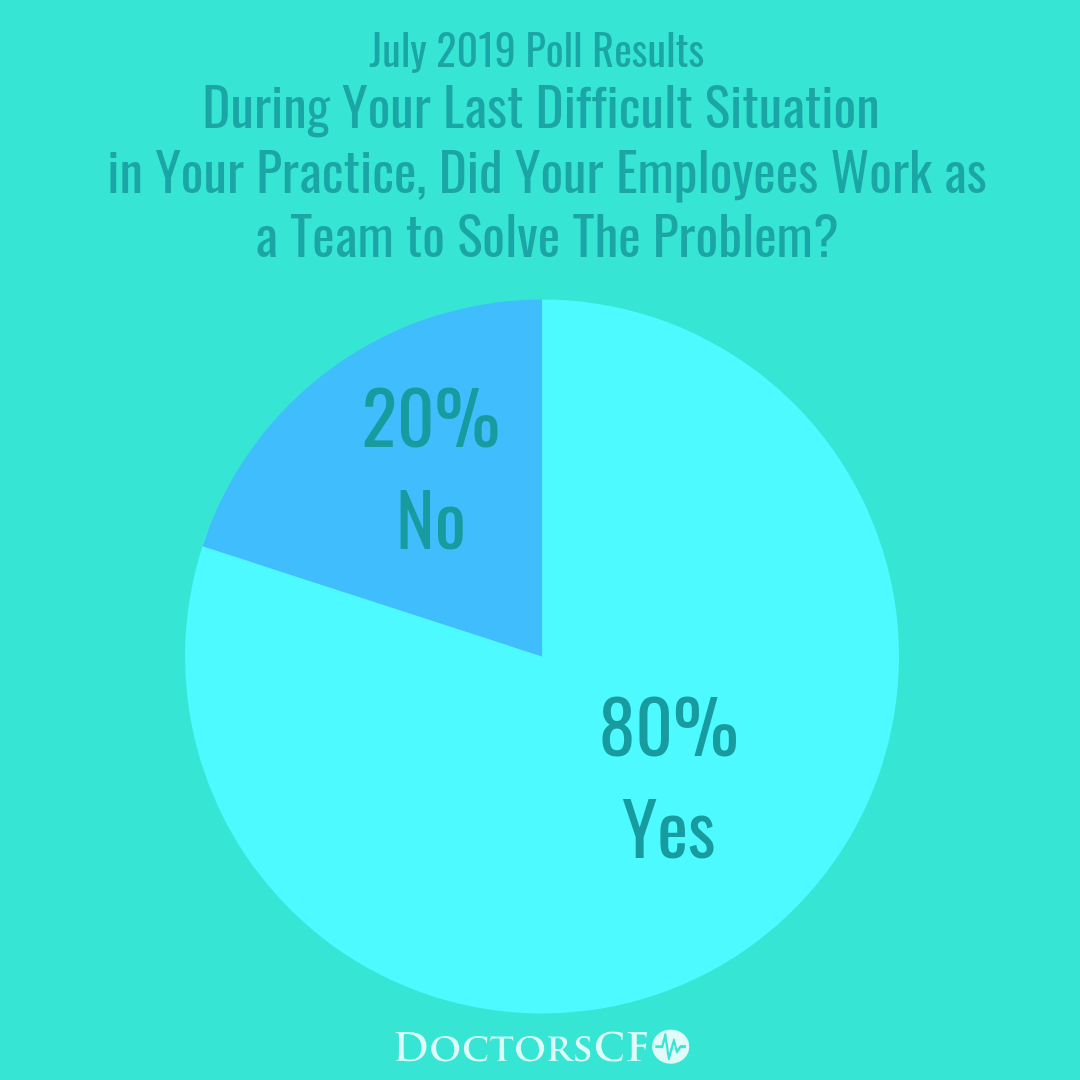

Our last blog was a personal anecdote that demonstrated the act of teamwork in stressful situations. I witnessed my dogs collaborate to attack a weasel infringing on their territory. It reminded me of how employees working in a medical or dental office need to work as a team to solve problems whether it be a difficult patient, a problem in the schedule, an issue with insurance denying a claim, or something else. Our poll asked “During the last difficult situation in your practice, did your employees act as a team to solve the problem?”. Eighty percent of respondents said “Yes” and 20% said “No”. For those who responded “No”, there is more employee development needed.

In the past we have detailed the roles of many different team members in your practice. We have covered everyone who works within the office, and recently we have been writing about the roles of people who are not employees in the practice but help owners with running their business; CFO’s, CPA’s, and the owner’s spouse or long-term partner.

Many doctors and dentists are not experts at financial planning, and that is why we recommend practice owners meet with a Wealth Advisor annually at minimum. Their spouse or long-term partner should be attending these meetings as well.

This week, we will be going over the roles of the practice owner’s Wealth Advisor.

Grow Wealth

- Creating a customized financial plan is the first and most important thing a Wealth Advisor should be helping with.

- Budgeting and cash flow management will ensure that money is being proactively allocated for expenses.

- Debt to income ratios should be analyzed so that a debt management plan can be made.

Protect Wealth

- In order to protect your wealth, important documents like a will and power of attorney should be enacted.

- Creating a trust will retain your earnings privately and lessen you tax burden. It will also provide you with control over distribution of assets and plan for retirement.

- Protecting your assets from creditors and divorcing spouses can also be accomplished by a Wealth Advisor establishing a trust.

Pass Wealth

- Multi-generational planning will help you look 50 to 100 years into the future and include your children and grandchildren. This can get complex in your years to come, so a Wealth Advisor will know how to simplify.

- Predicting the amount of money your children will need for a college education may be something to have your Wealth Advisor do.

- Should you want to pass your practice to one of more of your children, a plan for multi-generational business succession will be implemented by your Wealth Advisor. If children are not part of your future, you may want to plan to pass your legacy on to a trusted friend or employee who has an interest in taking over your practice in years to come.

Increase Employee Retention

- Benefit options will retain and attract employees. Wealth Advisors should guide you and what benefits to offer and how to offer them.

- Offering to match contributions made by your employee will lower your income taxes.

- By keeping your best employees, you can increase your practice production and lower turnover costs.

Coordinate with Other Advisors

- Since earnings are generally spread out it is important for solid communication between Wealth Advisors, Accountants, Attorneys, and Insurance Agents. This will help to solidify plans and crystallize goals.

Recommend Family Protection.

- Life Insurance

- Disability Protection

- Health Insurance

Your Wealth Advisor should be helping you plan for the future by setting goals, protecting earnings through estate planning, and guiding you through financial decisions. By having an experienced Wealth Advisor, you can be confident that your earnings made by your business will take care of you and your family in years to come.

To participate in our blog this week, please subscribe to our mailing list and follow us on Instagram. “Have you met with your Wealth Advisor in the past twelve months?”

The reason we are publishing these articles is so that your office can increase its success. We appreciate your feedback on how we can help you more and love it when you pass these articles along to other practice owners and office managers.

Developing a management report is not easy and Doctors CFO currently has a robust model for most practice types that is customized for our monthly and bi-monthly clients. If you have questions on how this model applies to your practice or you are interested in applying the Doctors CFO model in your practice, via one of our annual, bi-monthly or monthly assessments, please contact us.

(c) 2019 Doctors CFO, All Rights Reserved

Recent Comments